The Canada Revenue Agency (CRA) processed over 33 million tax returns last year. An impressive 93% of Canadians filed their taxes online. Calgary businesses must submit their corporate tax returns within six months after their taxation year ends. This makes understanding the process vital for success.

Corporate tax returns in Calgary demand close attention to several key elements. Businesses need to track their deadlines and maintain proper documentation. They must also follow both federal and provincial rules carefully. Canadian corporations should report all income types. The CRA requires specific information returns submission – T4s and T5s for investment income by February 28, 2025.

Let us direct you through the steps to file your corporate tax return in Calgary. You will discover the deadlines that matter most and learn about documentation requirements. The guide covers available tax credits and ways to meet CRA regulations. Small business owners and large corporation managers will find this detailed approach helpful. It will give you the confidence to handle your corporate tax filing effectively.

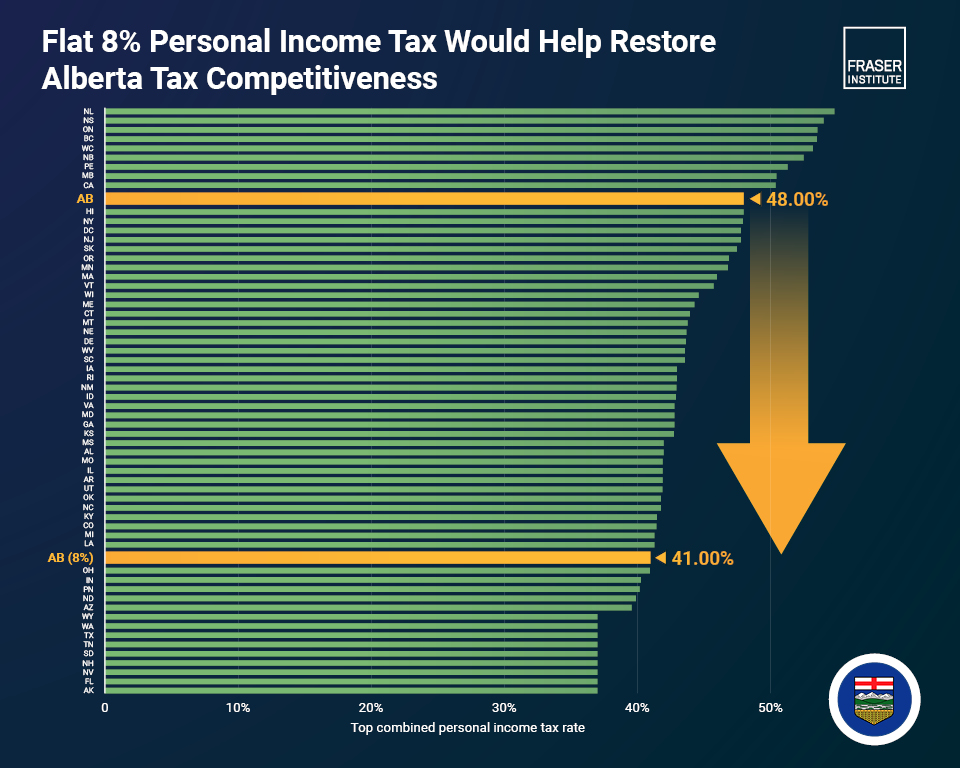

Understanding Corporate Tax Rates in Calgary for 2025

Image Source: Fraser Institute

“For a Canadian-Controlled Private Corporation, the Small Business Deduction remains a major perk. Qualifying CCPCs pay 9% federally on up to $500,000 of active income.” — BOMCAS Accountants, Professional Canadian accounting firm specializing in corporate tax

Calgary businesses must deal with both federal and provincial tax systems for their corporate tax returns. The 2025 tax year comes with specific rates and thresholds that business owners should know to plan their finances and stay compliant.

Federal corporate tax rates for Canadian businesses

The Canadian federal corporate tax system sets a simple rate of 38% on taxable income. A 10% federal abatement reduces this rate to 28%. Most corporations pay a net federal tax rate of 15% after the general tax reduction.

Canadian-controlled private corporations (CCPCs) receive better treatment from the federal government. CCPCs that qualify for the small business deduction pay a lower federal tax rate of 9% on eligible active business income.

The federal government now offers temporary rate cuts for specific industries. Companies making zero-emission technology pay reduced rates – 7.5% instead of 15% for general corporate income, and 4.5% instead of 9% for small business eligible income.

The federal corporate tax structure also has special rules for different types of income. CCPCs pay a higher federal rate of 38.67% on investment income because of an extra 10.67% refundable federal income tax. This higher rate shows the government’s push to support active business operations.

Alberta provincial tax rates

Alberta’s general corporate tax rate remains at 8% for 2025, making it the most competitive among all Canadian provinces. Calgary’s position as a prime location for business headquarters grows stronger because of this rate.

Alberta’s small businesses enjoy an even better deal. They pay a provincial rate of 2% for 2025 on eligible active business income. The total tax rate comes to 11% when combined with the federal small business rate of 9%.

The 2025 Alberta Budget kept these corporate tax rates unchanged, which helps businesses plan better. The combined federal-provincial general corporate tax rate stays at 23%, with 15% going to federal and 8% to Alberta.

Here’s how Alberta’s combined corporate tax rates compare:

| Business Type | Combined Rate (Federal + Alberta) |

|---|---|

| General corporate income | 23% |

| Small business eligible income | 11% |

| Investment income (CCPCs) | 46.67% |

Small business deduction eligibility in Calgary

The small business deduction (SBD) helps Calgary’s entrepreneurs by cutting tax obligations on their first portion of active business income. The SBD works as a tax credit rather than a deduction.

A corporation must stay Canadian-controlled and private throughout the tax year to qualify for the SBD. The credit applies to active business income from Canadian operations, but not to investment or “passive” income.

The small business threshold stands at $696,680.10 for 2025. This amount represents the maximum eligible active business income that qualifies for the lower rate. Associated corporations must share this threshold.

The SBD has important phase-out rules. The upper limit for taxable capital increased from $20.90 million to $69.67 million for taxation years starting April 7, 2022, or later. More medium-sized Calgary businesses can now benefit from the SBD because of this change.

The SBD limit starts decreasing when a CCPC’s adjusted total investment income exceeds $69,668.01. The SBD disappears completely at $209,004.03 of investment income. This rule pushes businesses toward active operations instead of passive investments.

Alberta’s SBD follows the federal structure but uses the provincial rate. The maximum deduction equals the amount taxable in Alberta multiplied by the small business deduction rate.

Calgary business owners can plan better and reduce their tax burden by understanding these corporate tax rates and thresholds. This knowledge helps them stay compliant with both federal and provincial rules.

Preparing Your Financial Documents

Image Source: Document Management Blog | MES – MES Hybrid Document Systems

Your corporate tax filing process in Calgary needs proper financial documentation as its foundation. The Canada Revenue Agency (CRA) expects every business to follow specific record-keeping requirements to file taxes smoothly and stay compliant. Here’s what you need to know about the documents and their management.

Essential financial statements required

The right financial statements are the starting point to prepare your corporate tax return. The CRA wants businesses to use the General Index of Financial Information (GIFI) system. This system gives unique codes to standard financial statement items. “Cash” gets code 1001, while “Office expenses” gets code 8810.

Your corporate tax filing needs these key financial documents:

- Trial Balance: A report that shows all individual accounts in your ledger and makes sure total debits equal total credits

- General Ledger: A detailed record of your fiscal year’s financial activities with transaction dates, descriptions, and amounts

- Balance Sheet Information: Schedule 100 of your T2 return shows your company’s financial position at a specific time

- Income Statement Information: Schedule 125 lists your revenues, expenses, and earnings

- Accounts Receivable/Payable aging reports: These show outstanding customer payments and vendor obligations

- Fixed Asset continuity schedule: This tracks capital assets and cumulative depreciation

Companies with less than CAD 1.39 million in both gross revenue and assets can use Form T1178 (a simplified GIFI form) to file financial information. Larger corporations must complete the more detailed Schedules 100, 101, 125, and 141.

Record-keeping best practices for Calgary businesses

Calgary businesses must keep all financial records for at least six years from the end of the latest taxation year. Some documents need even longer storage – corporations must keep their minutes of directors’ and shareholders’ meetings, share registers, general ledger, and important contracts from incorporation until two years after dissolution.

Your records will work better if you:

- Keep business and personal bank transactions separate to show business activities clearly

- Track all business loans and keep accurate records of salary or dividend payments throughout the fiscal year

- Keep detailed records of wages, salaries, bonuses, and commissions for employees

- Create retention schedules that line up with CRA requirements

Electronic records need to stay in a readable format during the required period, even when hard copies exist. Your electronic systems should produce available records when the CRA asks.

Digital document organization systems

Digital record-keeping gives Calgary businesses substantial advantages today. The CRA accepts electronic records that meet their standards for accessibility and security.

Your electronic record-keeping systems should:

- Capture enough detail to verify income and consumption taxes

- Archive or back up data files properly

- Restore backed-up data in an available format for CRA review

- Keep documentation that explains your operating and business systems

Xero and Hubdoc are making financial record-keeping easier for many Calgary businesses. Hubdoc uses optical character recognition (OCR) technology to pull relevant data from receipts automatically. This creates a quick way to categorize and store financial documents.

Make your digital organization better by:

- Setting up logical folders based on document type and retention deadlines

- Converting paper documents to digital files and storing them safely in the cloud

- Running regular backups to protect your data

- Creating daily habits to process and file financial documents

These practices will help you build an organized financial documentation system. This system will meet CRA requirements and make your corporate tax filing process in Calgary run smoothly.

Registering with CRA and Setting Up Filing Accounts

Setting up secure online access to the Canada Revenue Agency (CRA) helps you manage your corporate tax obligations better. Calgary business owners can streamline their tax filing process and get immediate access to corporate information by setting up CRA accounts.

Creating your CRA My Business Account

My Business Account is your online portal to interact with the CRA for business accounts of all types. This includes GST/HST, payroll, corporation income taxes, excise taxes, and other levies. Business owners, partners, directors, and officers can use this portal to handle their tax affairs.

To register for a CRA My Business Account, here’s what you need to do:

- Visit the CRA My Business Account website and select “CRA register” under Option 2

- Enter your Social Insurance Number (SIN) to validate your identity

- Provide your postal code or zip code, date of birth, and an amount from one of your income tax returns (current or previous tax year)

- Choose how you want to receive your CRA security code

- Create a CRA user ID and password

- Select and answer five security questions to recover your account if needed

- Review and agree to the terms and conditions

- Enter your Business Number after you get and input your security code

Your original registration gives you limited access to services like viewing return status, RRSP deduction limits, and payment capabilities. You’ll get full account access after your identity is verified.

Digital verification services for faster access

The standard process requires waiting up to 10 business days to receive a CRA security code by mail. The CRA now offers a document verification service that gives you immediate access to your account.

You’ll need:

- To be 16 years of age or older

- An accepted government-issued photo ID

- A mobile device with a working camera

The document verification works through:

- Taking a picture of yourself right then

- Taking a picture of your government-issued ID

The service accepts these three types of identification documents:

- Canadian passport

- Canadian driver’s license

- Provincial or territorial photo ID card

We developed this service with Interac to boost security and eliminate waiting periods. You can still verify your identity with a mailed CRA security code if you can’t use the document verification service.

Managing multiple business accounts

Calgary businesses often operate with multiple locations, business activities, or departments that need separate tracking of GST/HST and payroll accounts. My Business Account lets you manage all these accounts in one place.

To add program accounts to your existing Business Number (BN), you should have:

- Your business number

- The business’s legal name

- SIN of at least one owner/director/partner

- Answers to all questions in Part A of Form RC1

The five major CRA business account types are:

- RT (Goods and services tax/harmonized sales tax)

- RP (Payroll deductions)

- RC (Corporate income tax)

- RR (Registered charity)

- RZ (Information returns)

Using the complete 15-character business number (including program identifier and reference number) is vital in all CRA communications.

You can self-serve and re-register without contacting the CRA if you have a temporary SIN previously registered with a CRA account and now have a new SIN. The CRA has also made it easier to access multiple portals with a single sign-in.

Business Registration Online (BRO) is the quickest way to register for additional program accounts if you’re expanding operations. This service lets you register for GST/HST, payroll deductions, corporation income tax, and other accounts in one place.

Keeping your business information current with the CRA is essential since they can only provide information to specific individuals listed for the business number. The CRA needs proper authority and consent to accept changes or add representatives.

Key Corporate Tax Deadlines for Calgary Businesses

“When the corporation’s tax year ends on the last day of a month, file the return by the last day of the sixth month after the end of the tax year.” — Canada Revenue Agency (CRA), Government of Canada, official tax authority

Calgary businesses must meet corporate tax deadlines to avoid getting pricey penalties and interest charges. The Canada Revenue Agency (CRA) sets specific timelines for both filing returns and making tax payments. These timelines vary based on your corporation’s fiscal structure and year-end date.

Standard filing deadlines based on fiscal year

Calgary corporations need to file tax returns within six months after each tax year ends. Your corporation’s tax year matches its fiscal period, which might not line up with the calendar year.

Your specific due date depends on your fiscal year’s end:

- The last day of the sixth month following year-end applies when your fiscal year ends on the last day of a month

- The same day of the sixth month after year-end applies when your fiscal year ends on any other day

To name just one example, see:

- Fiscal year ending March 31, 2025: Filing deadline is September 30, 2025

- Fiscal year ending August 31, 2025: Filing deadline is February 28, 2026

- Fiscal year ending October 2, 2025: Filing deadline is April 2, 2026

Starting 2024, all corporations must file their T2 Corporation Income Tax Return electronically. This rule has limited exceptions for insurance corporations, non-resident corporations, corporations reporting in functional currency, and tax-exempt corporations. Companies that don’t file electronically face a CAD 1,393.36 penalty.

Payment due dates vs. filing due dates

You get six months to file your return, but payment deadlines arrive much sooner. This difference is vital for cash flow planning.

The balance-due day (final payment deadline) usually falls:

- 2 months after fiscal year-end for most corporations

- 3 months after fiscal year-end for qualifying Canadian-Controlled Private Corporations (CCPCs)

CCPCs can qualify for the extended 3-month payment deadline if they claim the Alberta small business deduction and their taxable income stays at CAD 696,680.10 or less in the current taxation year.

Corporations must also make installment payments on their estimated total tax throughout the year. Your payment schedule determines installment due dates:

- Monthly installments: Due on the last day of each month during your taxation year

- Quarterly installments: Available to qualifying CCPCs that have perfect compliance history and taxable income of CAD 696,680.10 or less

Your first installment payment comes due:

- For monthly installments: One month less a day from your tax year’s start

- For quarterly installments: One quarter less a day from your tax year’s start

The Alberta Tax and Revenue Administration (TRA) offers several payment options because timely payment matters. You can pay electronically through financial institutions, use credit cards via third-party providers like PaySimply, send Interac e-transfers, use PayPal, or stick to traditional methods like cheques or money orders.

Extension options for Calgary corporations

Canadian tax authorities don’t automatically grant filing extensions, but some situations might give you extra time:

Your return or payment stays on time if received by the next business day when a filing or payment due date lands on a Saturday, Sunday, or CRA-recognized public holiday. Alberta’s Tax and Revenue Administration follows this same rule for provincial tax deadlines.

The Canadian system differs from the U.S. as it lacks a formal extension request process. Here’s what corporations should do instead:

- File early to avoid last-minute issues

- Pay what you can by required deadlines even if your return isn’t ready

- Keep communication open with CRA if problems arise

Note that filing your return on time helps you avoid late-filing penalties, even if you can’t pay everything you owe. The CRA charges both installment interest on late or insufficient installment payments and penalties for missed deadlines.

Corporations looking for refunds must file within three years of their tax year’s end. The CRA won’t issue refunds after this period, even if you’re entitled to one.

Step-by-Step Guide to Filing Your Corporate Tax Return

Corporate tax filing in Calgary demands specific forms and proper procedures. The 2025 tax year makes electronic filing mandatory for most corporations. Businesses need a clear understanding of this process to stay compliant.

Completing the T2 corporate tax return

The T2 Corporation Income Tax Return serves as the primary form to report business income. Canadian corporations, including those in Calgary, must submit this return each year—even without tax obligations. Qualifying businesses can use the T2 Short Return, which provides a simplified two-page version based on specific criteria.

Your T2 return needs these steps:

- Gather your year-end financial statements and tax documentation

- Determine if you qualify for the Alberta small business deduction

- Calculate your federal and provincial tax liability

- Complete all required schedules and forms

- Review for accuracy before submitting

Required schedules for Alberta businesses

Corporate returns must include several key schedules:

- Mandatory schedules:

- Schedule 100: Balance sheet information

- Schedule 125: Income statement information

- Schedule 141: GIFI additional information

Common additional schedules include Schedule 50 (shareholder information), Schedule 7 (investment income data), Schedule 8 (capital cost allowance), and Schedule 6 (capital property dispositions).

Alberta businesses must complete the AT1 Alberta Corporate Income Tax Return with their federal T2. Companies should submit this provincial form within six months of their corporation’s taxation year-end.

Electronic filing options

Most corporations must file electronically for tax years after 2023. This requirement comes with a CAD 1,393.36 penalty for non-compliance. Insurance corporations, non-resident corporations, and certain tax-exempt organizations can claim exemptions.

Electronic filing methods include:

- Netfile: The standard method to submit AT1 and T2 returns

- Corporation Internet Filing: Available through the CRA website for 2002 and later tax years

- Tax preparation software: CRA-certified software generates the required “.cor” file

Companies benefit from electronic filing through immediate confirmation, faster processing, quicker refunds, and less paperwork.

Paper filing procedures

Corporations exempt from electronic requirements can still file paper returns. The paper filing process requires:

- Complete all required forms and schedules

- Ensure all information is accurate and legible

- Include your Business Number on all correspondence

- Mail to your location’s appropriate CRA tax center

The CRA sends a Notice of Assessment after processing your return. Refunds come through direct deposit or cheque. Tax payments can be made through online banking, financial institutions, or mail.

Navigating Alberta-Specific Tax Credits and Deductions

Tax credits and deductions unique to Alberta can substantially reduce your corporate tax burden in Calgary. These province-specific incentives reward state-of-the-art solutions and investment that complement federal programs.

Alberta Innovation Employment Grant

The Innovation Employment Grant (IEG) started on January 1, 2021, as part of Alberta’s Recovery Plan to stimulate economic growth through R&D investments. Qualified corporations receive:

- 8% payment on eligible R&D spending in Alberta, up to your base level (your average R&D spending over the previous two years)

- A boosted 20% payment on eligible R&D spending that exceeds your base spending level

Small and medium-sized businesses are the primary targets for the IEG. Your corporation loses eligibility once your taxable capital hits CAD 69.67 million. A gradual phase-out starts at CAD 13.93 million.

Schedule 29 of your Alberta Corporate Income Tax Return (AT1) is needed to claim the IEG. The CRA must verify your expenses before Tax and Revenue Administration processes your payment since eligible expenditures must match those qualifying for the federal Scientific Research and Experimental Development (SR&ED) program.

Capital cost allowance considerations

Business assets like equipment, furniture, or vehicles cannot be deducted fully right away. You claim a portion over time through Capital Cost Allowance (CCA). This strategy offers long-term tax benefits for your capital investments.

Alberta uses the federal CCA system but needs a separate AT1 Schedule 13 if your opening undepreciated capital cost (UCC) or CCA claimed is different from federal amounts. On top of that, it automatically adopts federal CCA changes, including Budget 2021 updates.

CCA classes group similar assets with specific depreciation rates. Common classes include Class 8 (20% rate) for items like furniture, Class 10 (30% rate) for most vehicles, and accelerated classes for zero-emission vehicles bought after March 18, 2019.

Research and development incentives in Calgary

Alberta Jobs, Economy and Trade Tax and Revenue Administration offers more tax credits beyond the IEG:

- Film and Television Tax Credit (FTTC) for production companies

- Agri-Processing Investment Tax Credit (APITC) for agricultural businesses

Note that Alberta’s 8% corporate tax rate—the lowest in Canada—creates a naturally supportive environment for R&D activities. Calgary businesses that accept new ideas benefit from one of North America’s most competitive tax structures thanks to these targeted incentives.

Your R&D documentation practices should match federal SR&ED requirements to maximize benefits, as Alberta’s programs typically verify eligibility through the federal validation process.

Managing Corporate Passive Income Taxation

Tax authorities give special treatment to corporate passive income. This can substantially affect your Calgary business’s overall tax position. Your business earns passive income from investments rather than active operations, and it faces higher tax rates that might reduce valuable small business deductions.

Passive income thresholds and implications

Corporate passive income in CCPCs leads to the refundable dividend tax on hand (RDTOH) and tax rates reach nearly 50% across Canada. Your small business deduction (SBD) limit starts to decrease when your corporation’s passive income exceeds $69,668.01 in a fiscal year. You lose $6.97 of your $696,680.10 SBD limit for every $1.39 above this threshold. Your SBD disappears completely once passive income hits $209,004.03.

The reduction means your active business income will face taxation at the higher general corporate rate instead of the preferential small business rate. This reduces the potential tax deferral advantage of retaining funds in your corporation substantially.

Investment income reporting requirements

Each type of passive income needs different reporting:

- Interest income and foreign income face taxation as regular income at the passive income tax rate, with some tax being refundable

- Capital gains offer more tax efficiency since only half are taxable at the passive income rate

- Canadian corporation dividends face a 38.33% refundable tax

The CRA uses notional accounts to track these—the non-eligible refundable dividend tax on hand (NERDTOH) and eligible RDTOH (ERDTOH) accounts. Associated corporations must add up their passive income to check if they’ve exceeded the $69,668.01 threshold, unlike most business decisions.

Strategies to optimize passive income taxation

Your Calgary corporation can minimize passive income tax effects through these steps:

- Put money in capital gains-producing assets since only 50% of gains face taxation

- Use your Capital Dividend Account (CDA) to give out the non-taxable portion of capital gains tax-free

- Think over withdrawing corporate funds to maximize personal RRSP and TFSA contributions

- Look into Individual Pension Plans (IPPs) as passive income approaches the threshold

- Check out corporate-owned exempt life insurance policies where investment growth doesn’t affect your SBD

Smart timing of capital gains realization and strategic dividend distribution planning can help manage your overall tax position, especially when your Calgary business approaches the passive income threshold.

Post-Filing Procedures for Calgary Corporations

Your corporate tax return submission is just the beginning. Calgary businesses must follow several post-filing procedures to stay compliant with federal and provincial regulations.

Record retention requirements

Keeping your business records is a vital legal requirement after filing. Your corporation must keep all records and supporting documents for six years from the end of the last tax year they relate to. This requirement covers financial statements, receipts, invoices, and other tax-related documents.

The rules are different for dissolved corporations. You must keep permanent records like minutes, share registers, general ledger, and key contracts for two years after dissolution. Non-permanent records also need a two-year retention period.

Your business might need longer record keeping in these cases:

- Late return filing requires six-year record keeping from the actual filing date

- Records must stay intact during objections or appeals until resolution

- The Minister of Finance can ask you to keep records for an additional period

Keep in mind that you must store electronic records in machine-readable format, even if paper copies exist.

Handling CRA reviews and audits

The CRA uses risk-assessment systems to find tax returns with high non-compliance risk. An audit usually starts with a phone call and a follow-up confirmation letter.

CRA officers look at:

- Business records (ledgers, invoices, contracts)

- Business owners’ personal records (bank statements, mortgage documents)

- Records of related individuals or entities

The CRA often turns to “indirect verification of income” methods when books show potential errors or mixed business and personal accounts. They commonly use the “net worth method” to check changes in assets, liabilities, and spending patterns.

If you disagree with audit findings, reach out to the auditor first. The team leader should be your next step if problems remain.

Amending previously filed returns

Wait for your Notice of Assessment before fixing any errors you find in your filed return. Your corporation can request adjustments through:

- Commercial tax preparation software electronically

- Bar codes with reassessment information

- A letter to your tax center with supporting documents

To carry back losses or credits from previous years, you’ll need these schedules:

- Schedule 4 for losses

- Schedule 21 for foreign tax credits

- Schedule 31 for investment tax credits

- Schedule 42 for Part I tax credits

Alberta’s Tax and Revenue Administration understands that unexpected circumstances can prevent timely compliance. They may show flexibility regarding penalties or interest.

Conclusion

Calgary businesses must pay close attention to detail when filing corporate tax returns. They need a deep understanding of federal and provincial requirements. Keeping accurate records, meeting deadlines and staying up-to-date with regulations are essential. Your stress levels will drop substantially during tax season if you prepare properly throughout the year. This approach also helps maximize your deductions and credits.

Calgary corporations benefit from Alberta’s competitive tax environment. The state-of-the-art Employment Grant and specialized industry credits create many more opportunities. Business owners should plan carefully and document everything properly during the fiscal year. Small business owners must keep track of their passive income levels. This helps them stay below thresholds that might affect their small business deduction eligibility.

Professional guidance is a great way to get through complex corporate tax requirements. BOMCAS Accountants in Calgary can help with all your corporate tax needs. Their expertise ensures you comply with regulations and maximize your deductions and credits.

Effective corporate tax management goes beyond yearly filing. Calgary businesses succeed when they monitor financial records regularly and keep documentation systems organized. Companies that review their tax strategies every quarter take full advantage of available credits. This approach helps them stay compliant with CRA requirements.

FAQs

Q1. When is the deadline for filing corporate tax returns in Calgary? Corporate tax returns must be filed within six months after the end of your corporation’s tax year. For example, if your fiscal year ends on December 31, 2025, your filing deadline would be June 30, 2026.

Q2. What are the key documents needed to file a corporate tax return in Calgary? Essential documents include your financial statements (balance sheet and income statement), trial balance, general ledger, and fixed asset schedule. You’ll also need to complete the T2 Corporation Income Tax Return and relevant schedules.

Q3. How can Calgary businesses reduce their corporate tax burden? Calgary businesses can reduce their tax burden by taking advantage of Alberta-specific tax credits like the Innovation Employment Grant, optimizing capital cost allowance claims, and carefully managing passive income to maintain small business deduction eligibility.

Q4. What are the consequences of filing a corporate tax return late in Calgary? Late filing can result in penalties and interest charges. The penalty is typically 5% of the unpaid tax plus 1% of the unpaid tax for each complete month the return is late, up to a maximum of 12 months.

Q5. How long should Calgary corporations keep their tax records? Generally, corporations must retain all records and supporting documents for six years from the end of the last tax year they relate to. However, certain permanent records for dissolved corporations must be kept for two years after dissolution.

View Our Location

View Our Location

181 Meadowview Bay, Sherwood Park, AB T8H 1P7, Canada (Online Clients Only)

181 Meadowview Bay, Sherwood Park, AB T8H 1P7, Canada (Online Clients Only)