Sustainable Tax Incentives: How Green Initiatives Can Save Your Business Money (2026 Update)

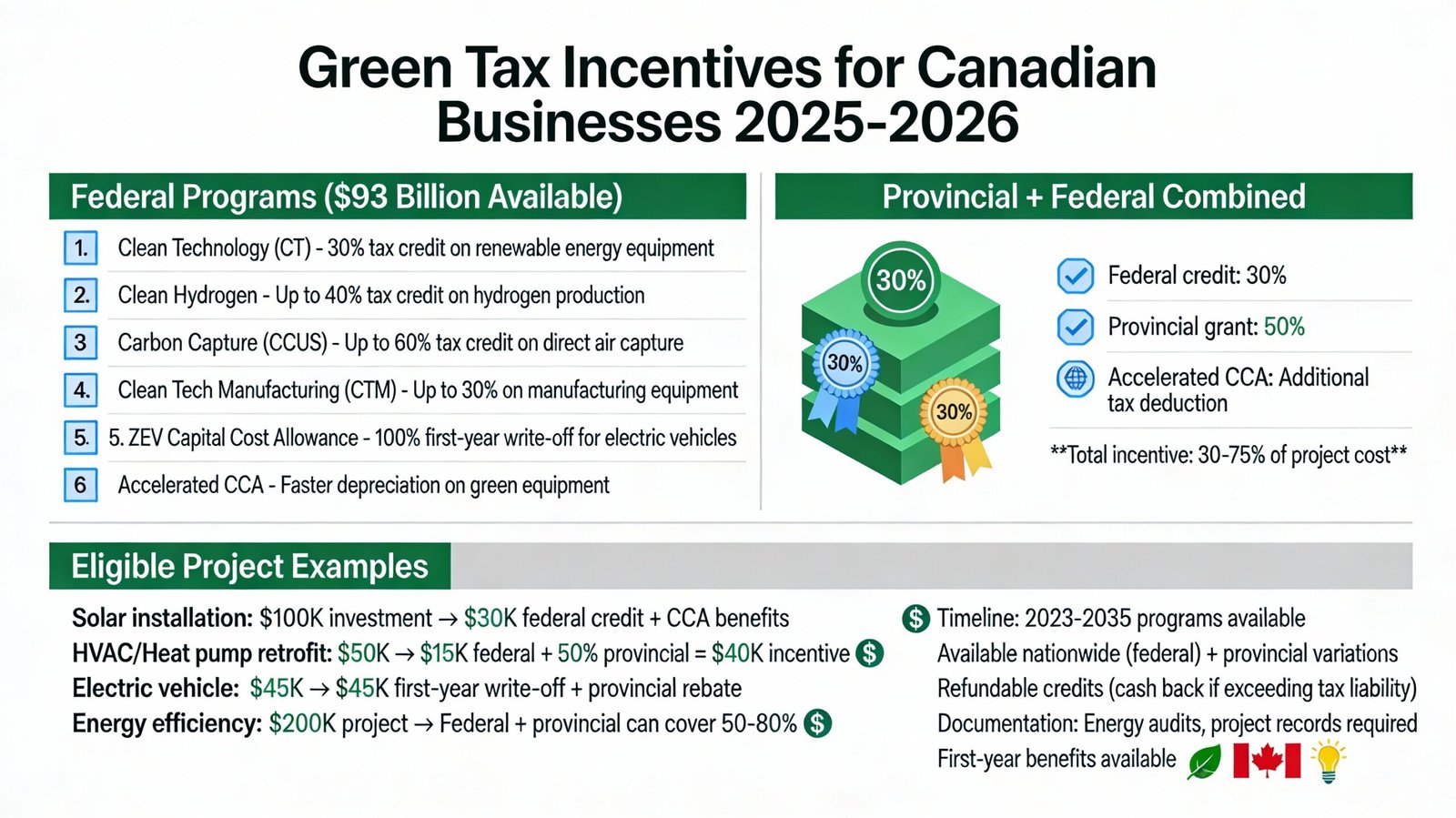

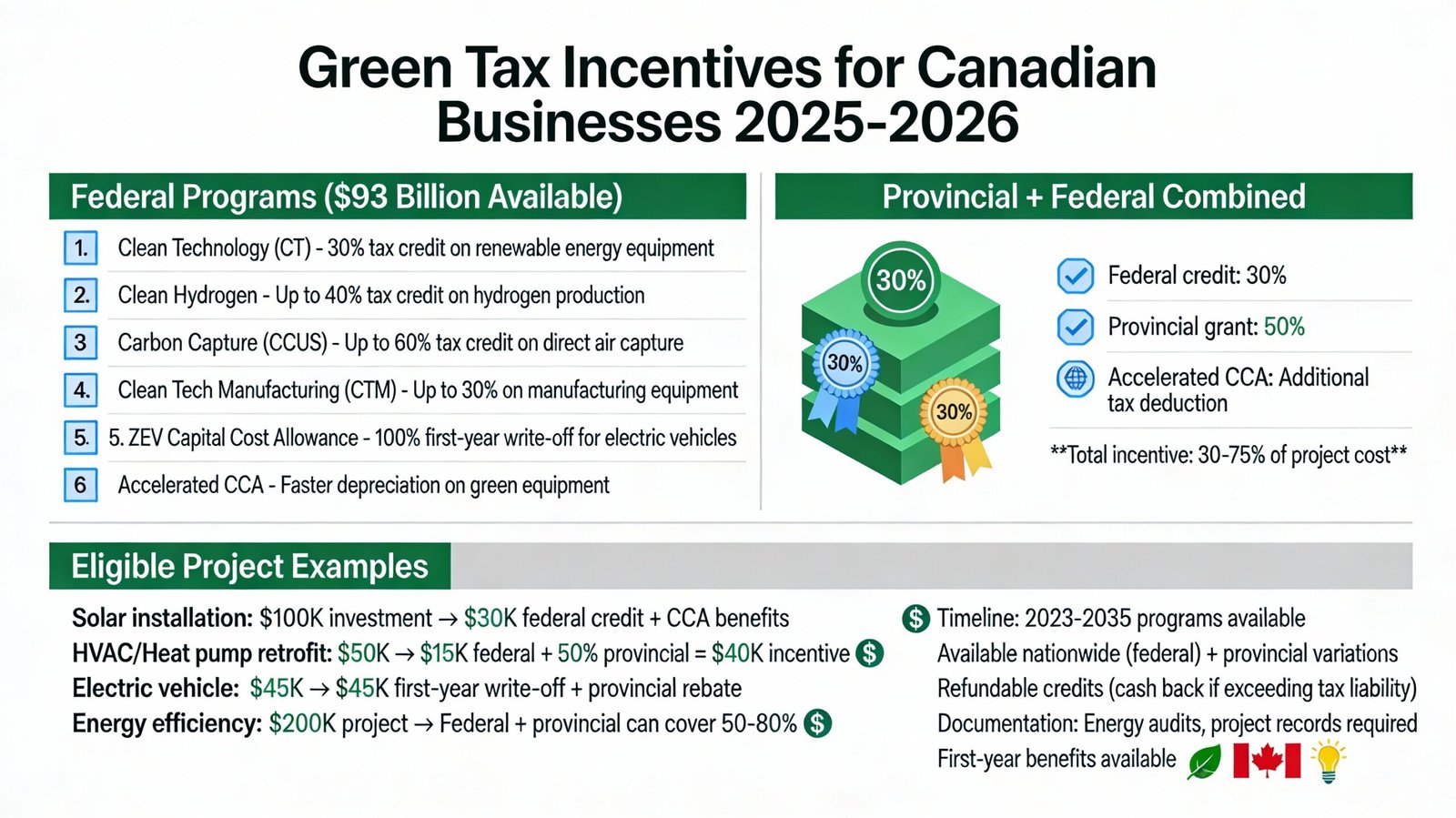

Executive Summary Green business initiatives are no longer just an environmental responsibility—they're a financial...

Providing Professional services in Canada.

Accounting is essential for managing and analyzing financial information, empowering businesses in Canada. It ensures sound financial decision-making, compliance, and meaningful insights into performance.

Accounting is the backbone of financial management for businesses in Canada. Its role in maintaining accurate financial records, ensuring compliance, and providing meaningful insights cannot be overstated. By understanding the importance of accounting, following best practices, and leveraging its benefits, businesses can navigate the financial landscape with confidence and drive long-term success.

Executive Summary Green business initiatives are no longer just an environmental responsibility—they're a financial...

Executive Summary Payroll is one of the most legally complex and audit-heavy functions in...

Executive Summary Running a startup in Canada's 2025–2026 economy is fundamentally different from the...

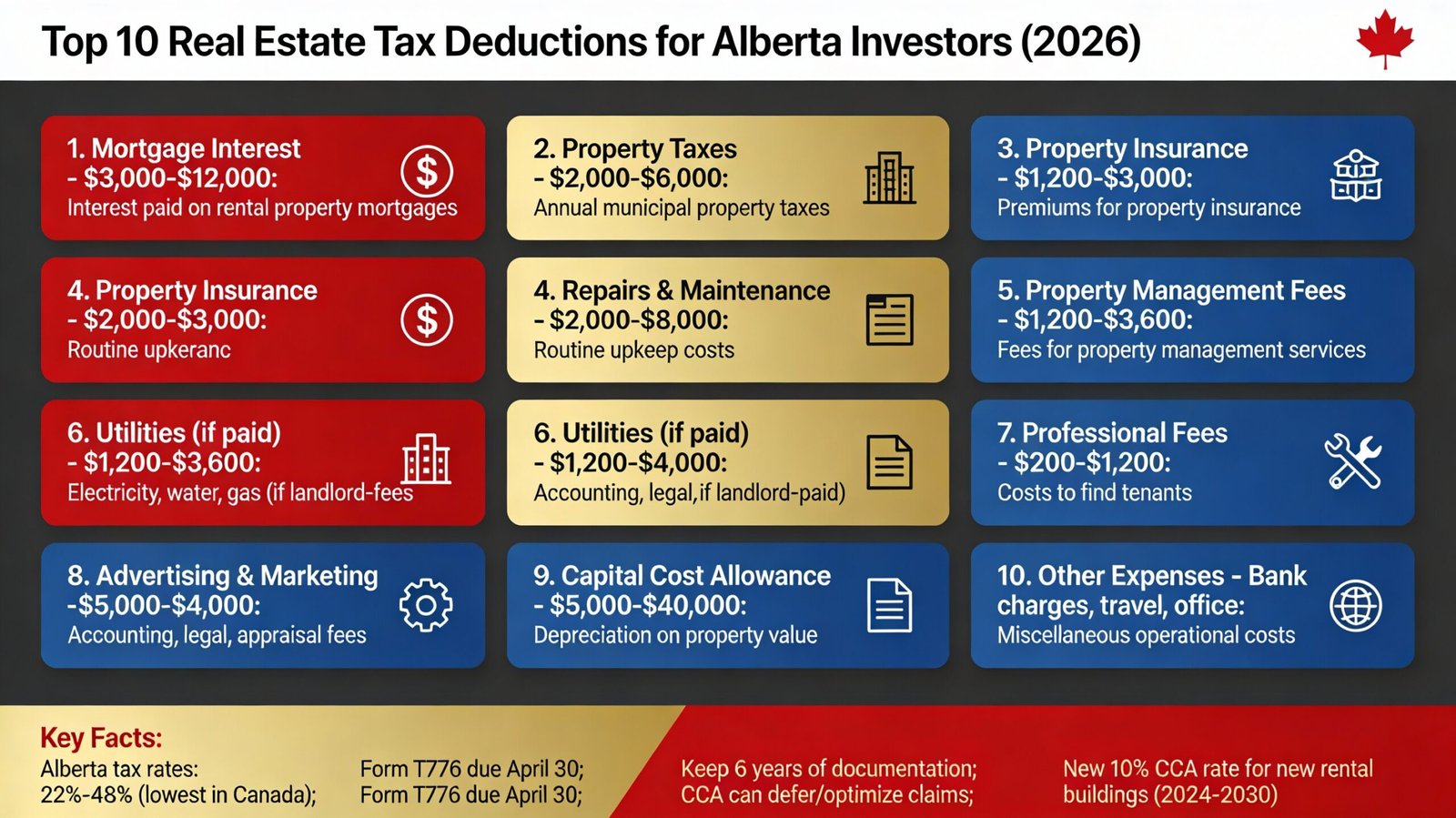

Executive Summary Real estate investment in Alberta offers one of Canada's most favorable tax...

A Step-by-Step Guide for BOMCAS Canada Clients AI Bookkeeping Implementation Checklist for Canadian SMBsDownload...

Executive Summary The landscape of Canadian small business bookkeeping is undergoing a seismic shift....

Can non-residents claim Canadian tax credits? Learn everything you need to know for 2025....

BOMCAS Canada – Your Trusted Canadian Accounting & Tax Experts Payroll and CPP Rules...