Executive Summary

Canada’s self-employed community faces unique tax challenges that salaried employees never encounter. Without an employer deducting taxes automatically, freelancers must understand quarterly instalment payments, CPP contributions (which are 100% their responsibility), RRSP strategies to build retirement savings, income splitting opportunities, and a comprehensive list of 30+ deductible business expenses.

The stakes are high. A freelancer earning $100,000 who doesn’t track expenses might overpay taxes by $15,000-$25,000. A freelancer who doesn’t contribute to CPP early might face a $300,000+ retirement shortfall over 30 years. A freelancer who overlooks income splitting strategies might pay 10-15% more in family taxes than necessary.

This comprehensive guide explains every tax advantage available to Canadian freelancers and self-employed individuals, walks you through the T2125 form (required for all self-employment income), shows you how to maximize RRSP contributions and tax deductions, explains CPP contributions, reveals income-splitting strategies compliant with TOSI (Tax on Split Income) rules, and recommends the best expense-tracking apps and tools for staying CRA-compliant.

For Canadian freelancers, understanding and implementing these tax strategies is the difference between thriving profitably and struggling with unnecessary tax burden.

Part 1: Understanding Your Tax Obligations as Self-Employed

You Are Responsible for Everything

What Employees Get Automatically (You Must Do Manually):

- Income tax withholding (you must pay quarterly instalments if owing $3,000+)

- CPP contributions (you pay BOTH employee and employer portions—9.9% total)

- EI contributions (not available to self-employed; you need private insurance)

- Record-keeping and receipts (CRA audit-proof documentation)

Key Difference from Employees:

- Employees: Taxes deducted automatically, employer contributes to CPP

- Self-employed: You pay all taxes and CPP yourself, deduct expenses, track everything

T2125 Form: Required for All Self-Employment Income

What Is T2125:

The “Statement of Business or Professional Activities” form on which all self-employed Canadians report:

- Business income

- Allowable expenses

- Net business income (taxable income)

- CPP contributions

Quebec Exception:

- Quebec self-employed file Form TP-80-V instead of T2125

- Same information required, different form

Who Must File T2125:

- Freelancers and independent contractors

- Business owners and professionals (doctors, lawyers, accountants, consultants)

- Commission sales people

- Farmers and fishers

- Anyone earning self-employment income

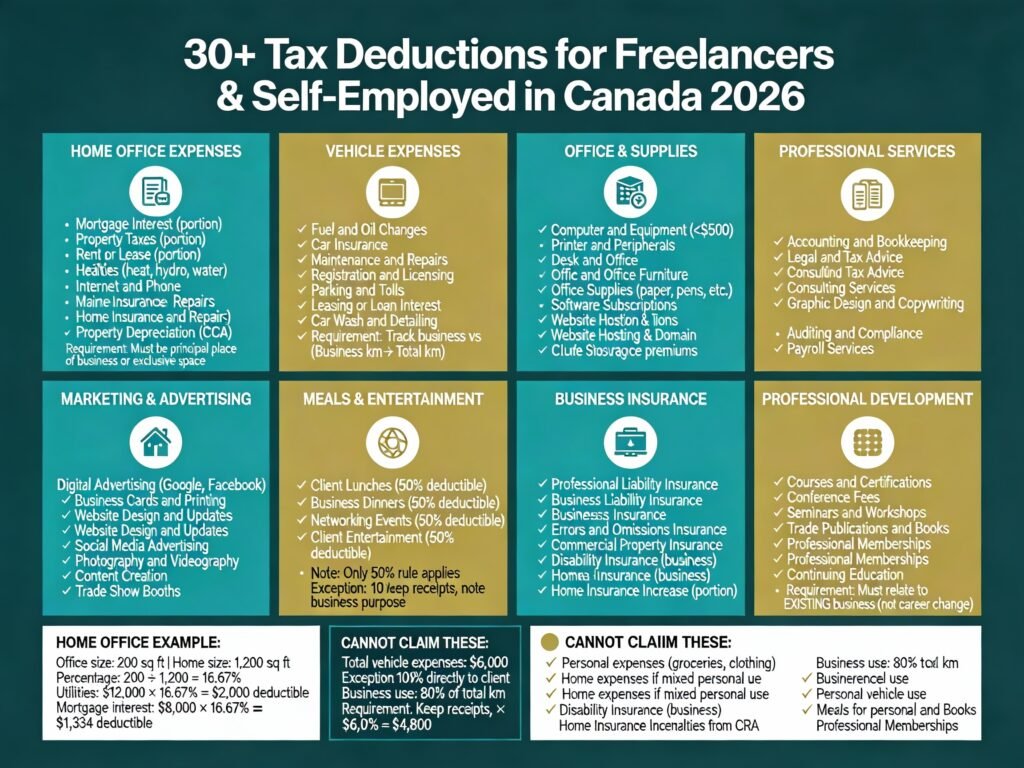

Part 2: The Complete List of Self-Employed Tax Deductions

Category 1: Home Office Expenses

Eligibility:

- Principal place of business, OR

- Exclusive space used regularly for business

Deductible Items:

- Rent or mortgage interest (proportional)

- Utilities (hydro, gas, water)

- Property taxes (proportional)

- Home insurance (proportional)

- Internet and phone

- Maintenance and repairs

- Property depreciation (CCA)

- Cleaning and supplies

Calculation:

- Business square footage ÷ Total home square footage = Percentage

- Multiply percentage × each expense

- Example: 200 sq ft ÷ 1,200 total = 16.67%

- $12,000 utilities × 16.67% = $2,000 deductible

Category 2: Vehicle Expenses

Eligibility:

- Vehicle used for business purposes

- Track business vs personal use

Deductible Items:

- Fuel and oil changes

- Insurance and registration

- Maintenance and repairs

- Parking and tolls

- Lease or loan interest

- Car wash and detailing

Calculation:

- Total vehicle expenses × (Business km ÷ Total km) = Deductible amount

- Example: $6,000 expenses × 80% business use = $4,800 deductible

Category 3: Office and Supplies

Fully Deductible:

- Office equipment (<$500): Computer, printer, desk, chair

- Office supplies: Paper, pens, folders, sticky notes

- Software subscriptions: Accounting, design, productivity tools

- Website hosting and domain

Category 4: Professional Services

Fully Deductible:

- Accounting and bookkeeping fees

- Legal and tax advice

- Consulting services

- Graphic design and copywriting

- Auditing and compliance services

Category 5: Advertising and Marketing

Fully Deductible:

- Website design and updates

- Digital advertising (Google Ads, Facebook Ads)

- Business cards and branding

- Social media advertising

- Content creation (photography, videography)

- Trade show booths

Category 6: Meals and Entertainment (50% Only)

Rule:

- Only 50% of meal and entertainment expenses deductible

- Example: $200 client dinner = $100 deductible

Deductible Items (50%):

- Client lunches and dinners

- Business networking meals

- Client entertainment

100% Deductible:

- Meals billed directly to client

- Meals while on business travel

Category 7: Business Insurance

Fully Deductible:

- Professional liability insurance

- Business liability insurance

- Errors and omissions coverage

- Commercial property insurance

- Disability insurance (business-related)

Category 8: Professional Development

Fully Deductible:

- Courses and certifications

- Conference fees

- Seminars and workshops

- Trade publications and books

- Professional memberships and associations

Requirement:

- Must relate to your EXISTING business

- Cannot be for career change or new skill set

Category 9: Salaries and Wages (If You Have Employees)

Fully Deductible:

- Employee salaries and wages

- Bonuses and commissions

- Employee benefits (health, dental)

- CPP and EI contributions (employer portion)

- Workers compensation insurance

Category 10: Business Taxes and Licenses

Fully Deductible:

- Business license and registration fees

- Professional certifications

- Municipal business taxes

- Industry-specific licensing

Non-Deductible Expenses (YOU CANNOT CLAIM):

- Personal expenses (clothing, groceries, recreation)

- Home expenses if not used exclusively for business

- Charitable donations and political contributions

- Life insurance premiums

- Interest and penalties on late taxes

- Fines and penalties imposed by law

- Personal vehicle use (only business use)

- Meals for personal consumption

Part 3: The T2125 Form—Step-by-Step

Part 1: Basic Information

- Business description and activity code

- Year of business start

- Principal place of business

- Type of income (self-employment, commission, farming, fishing)

Part 2: Business Income

Report:

- Gross sales or professional fees

- GST/HST collected from clients

- Adjustments for discounts and returns

- Cost of goods sold (if applicable)

Part 3: Business Expenses

Line-by-line categories:

- Advertising

- Office expenses

- Meals and entertainment (50% rule applied)

- Wages and salaries

- Rent or lease

- Utilities

- Vehicle expenses

- Professional services

- Business insurance

- Other expenses

Total all expenses and subtract from gross income

Part 4: Net Income Calculation

Formula:

Gross Income

- Cost of Goods Sold

- Total Business Expenses

= Net Business Income (Taxable)

Part 5: Capital Cost Allowance (CCA)

If you own capital property (>$500):

- Equipment and machinery

- Vehicles and tools

- Furniture and appliances

- Buildings and renovations

CCA claim using CRA classes and depreciation rates

Part 6: Business-Use-of-Home Expenses

If home office is principal place of business:

- Calculate home office percentage

- Report qualifying home expenses

- Note: Cannot create or increase a business loss

Part 4: CPP Contributions—The Hidden Tax

Self-Employed CPP Is 100% Your Responsibility

Key Difference:

- Employees: Pay 5.95%; employer matches 5.95%

- Self-employed: Pay 11.9% (both portions) yourself

2025 CPP Maximums for Self-Employed:

- Basic contribution: 5.95% on income up to $71,300 = $4,244.35

- Enhanced contribution (CPP2): 4% on income $71,300-$85,000 = $560

- Total maximum CPP: $8,804.35 (for 2025)

CPP2 (Expanded Contribution):

- Starting January 1, 2024

- Additional 4% on earnings between first and second ceiling

- Provides extra retirement income

- Required for all self-employed

How to Calculate Your CPP Contribution

Step 1: Calculate Net Self-Employment Income

- From T2125 net business income

Step 2: Apply CPP Rate (5.95%)

- Net income × 5.95% = CPP1 contribution

Step 3: Apply CPP2 Rate (4% if applicable)

- Income between $71,300-$85,000 × 4% = CPP2 contribution

Step 4: Claim Deduction on Tax Return

- 50% of total CPP is deductible (reduces taxable income)

Example: Freelancer with $100,000 Net Income

- CPP1: $100,000 × 5.95% = $5,950

- CPP2: ($85,000 – $71,300) × 4% = $552

- Total CPP owed: $6,502

- Deductible amount: $6,502 ÷ 2 = $3,251

- Tax savings: $3,251 × 35% marginal rate = $1,138 refund

Part 5: RRSP Strategy for Self-Employed—Build Retirement Tax-Free

RRSP Contribution Room Calculation

Your RRSP Room = Unused Room + New Room

New Room Calculation:

- Lesser of:

- 18% of PREVIOUS year’s earned income, OR

- Annual maximum ($32,490 for 2025; $33,810 for 2026)

- Minus: Pension adjustment (if applicable)

- Plus: Unused room from prior years

Example: Freelancer with $80,000 Income

- Previous year earned income: $80,000

- New room: 18% × $80,000 = $14,400

- Annual limit for 2025: $32,490

- Lesser of: $14,400 (your calculation)

- Unused room from 2024: $3,000

- Total 2025 RRSP room: $17,400

RRSP Tax Deduction Benefits

Key Advantage:

- 100% of RRSP contributions reduce taxable income dollar-for-dollar

Tax Savings Example:

- Contribute: $10,000 to RRSP

- Taxable income reduced by: $10,000

- At 40% marginal rate: $4,000 tax refund

- Your real contribution cost: $6,000 (after refund)

RRSP vs TFSA Strategy

RRSP:

- Immediate tax deduction (reduces taxes today)

- Tax deferred until withdrawal (pay tax on full amount when you retire)

- Maximum contribution: 18% of earned income (up to annual limit)

- Best for: High earners wanting to reduce current taxes

TFSA:

- No tax deduction (use after-tax dollars)

- Tax-free growth and withdrawals

- Maximum contribution: $7,000 per year (varies by year)

- Best for: Building wealth tax-free long-term

Part 6: Income Splitting for Self-Employed—TOSI Rules

What Is Income Splitting?

Income splitting allows you to allocate business income to a lower-income spouse or adult family member, taking advantage of lower tax brackets and reducing overall family tax.

TOSI (Tax on Split Income) Rules—2025 Update

The Challenge:

As of January 1, 2019, TOSI rules were expanded to include adults over 18 (previously only under 18). Split income of adults is taxed at the HIGHEST marginal rate, not the recipient’s rate.

Example—TOSI Penalty:

- You have $100,000 business income

- Spouse has $0 income (lower tax bracket)

- Previously (pre-2019): Could split to spouse, pay lower rate

- Now (post-2019): If income “split,” spouse pays highest rate anyway

TOSI Exemptions—Still Available:

Exemption 1: Adult Children Age 18-24 with Work Requirement

- Child works 20+ hours per week in your business, OR

- Worked 20+ hours per week in any 5 previous years

- Income from work is exempt from TOSI

- Dividends after working period remain exempt

- Must document the hours worked

Exemption 2: Business Owners Age 65+

- Spouses of business owners 65+ can receive “reasonable” income

- Income from business not subject to TOSI

- Must have contributed to business

Exemption 3: Capital Gains on Qualified Property

- Gains from selling qualified small business shares exempt

- Gains from selling qualified farm/fishing property exempt

Legitimate Income Splitting Still Possible:

Spousal Loan Strategy

- Lend money to spouse at CRA-prescribed rate (currently 2%)

- Spouse uses loan to earn investment income

- Spouse pays interest back to you

- Net income earned by spouse (minus interest) taxed in spouse’s hands

- Compliant with TOSI rules

Family Trust Strategy

- Family trust can allocate income to family members

- Must follow CRA rules (complex legal setup required)

- Requires professional tax planning

Paying Reasonable Salary to Spouse

- Pay spouse reasonable salary for work performed

- Must be at fair market rate for the work

- Must have clear documentation

- Spouse pays tax on salary, but in their bracket (usually lower)

- Deductible as business expense

Part 7: Quarterly Instalment Payments

Do You Need to Pay Quarterly Instalments?

Requirement:

- If you owe $3,000+ in self-employment taxes in current or prior year

- Must pay four quarterly instalments

Payment Dates:

- March 31 (Q1 estimate)

- June 15 (Q2 estimate)

- September 30 (Q3 estimate)

- December 31 (Q4 estimate)

Calculation:

- Last year’s tax owing ÷ 4 = Each quarterly payment

- Adjust if income changes significantly

Part 8: Expense Tracking Apps & Digital Tools

Best Apps for Canadian Freelancers

Expense Tracking Apps:

- Wave Receipts: FREE, scans receipts, categorizes expenses automatically

- Expensify: Real-time tracking, automatic receipt OCR, mobile app

- Dext: Automates receipt data entry, integrates with accounting software

Accounting Software (CRA-Approved):

- Wave Accounting: FREE, full bookkeeping and invoicing

- QuickBooks Canada: Industry standard, powerful reporting

- Xero: Cloud-based, excellent for multi-employee businesses

- Freshbooks: Invoice and expense tracking for service providers

Why Digital Tracking Matters

- CRA accepts digital receipts (must be readable, unaltered)

- Reduces time at tax time

- Prevents lost deductions

- Keeps records audit-ready

- Enables real-time financial tracking

CRA Requirements for Digital Records

Digital records must:

- Be readable and complete

- Remain unaltered

- Be accessible for 6 years minimum

- Can be cloud-stored (CRA accepts)

- Must be in electronic format if requested by CRA

Part 9: Real Examples & Calculations

Example 1: Freelance Writer—$50,000 Income

Income:

- Freelance writing fees: $50,000

Expenses:

- Home office (16.67%): $2,000

- Equipment (depreciation): $1,000

- Software subscriptions: $500

- Professional development: $800

- Meals with clients (50%): $300

- Internet and phone: $600

- Total expenses: $5,200

Net Self-Employment Income:

- $50,000 – $5,200 = $44,800

CPP Contribution:

- $44,800 × 5.95% = $2,666

- Deductible: $1,333

- Taxable income after CPP deduction: $44,800 – $1,333 = $43,467

RRSP Room:

- 18% × $44,800 = $8,064

- Annual limit: $32,490

- Available room: $8,064 (plus any unused from prior years)

Tax Owing (at 35% marginal rate):

- Taxable income: $43,467

- Tax: $43,467 × 35% = $15,214

- Less RRSP refund (if $8,000 contributed): $8,000 × 35% = $2,800

- Net tax owing: $12,414

Example 2: Consultant with Income Splitting—$120,000 Income

Scenario:

- Consultant: $120,000 net self-employment income

- Spouse: Part-time employee earning $20,000

Strategy 1: No Income Splitting

- Consultant pays tax on $120,000 at 40% = $48,000

- Spouse pays tax on $20,000 at 25% = $5,000

- Family total: $53,000

Strategy 2: Pay Spouse Reasonable Salary ($30,000)

- Consultant income: $120,000 – $30,000 (deductible salary) = $90,000

- Consultant pays: $90,000 × 40% = $36,000

- Spouse income: $20,000 + $30,000 = $50,000

- Spouse pays: $50,000 × 28% = $14,000

- Family total: $50,000

- Tax savings: $3,000 (legitimate income splitting)

Key: Salary must be reasonable for work performed and documented

Part 10: CRA Compliance—Avoid Audits

CRA Red Flags for Self-Employed

Expense Red Flags:

- Home office >50% of home

- Vehicle claimed 100% business (personal use obvious)

- Meal expenses >10% of income (CRA ratio-tests)

- Inconsistent deductions year-to-year

- Missing documentation for large claims

Income Red Flags:

- Significant drops in reported income

- No invoices or sales records

- Cash-only business with minimal documentation

- Payments not matching bank deposits

How to Stay Compliant

Documentation:

- Keep ALL receipts (digital or paper) for 6 years

- Use accounting software for real-time tracking

- Maintain separate business bank account

- Document business purpose for major expenses

- Keep mileage logs for vehicles

Professional Help:

- Hire accountant to file T2125 annually

- Costs $500-$2,000 (tax-deductible professional fee)

- Saves far more in optimized deductions and avoided penalties

- Reduces audit risk

Conclusion: Maximize Your Self-Employment Tax Position

For Canadian freelancers and self-employed individuals, understanding and implementing these tax strategies can mean the difference between thriving financially and struggling unnecessarily.

Your action plan:

- Set up expense tracking (Wave or Expensify)

- Open separate business bank account

- Organize receipts by category (home office, vehicle, etc.)

- Understand your CPP obligation (11.9% of net income)

- Maximize RRSP contributions (18% of earned income up to limit)

- Explore income splitting with spouse (salary, loan, or trust)

- Hire accountant to file T2125 (one-time cost, major savings)

- Track quarterly instalment requirements ($3,000+ threshold)

- Claim ALL eligible deductions (30+ categories available)

- Review tax return annually for optimization opportunities

Article created for BOMCAS Canada. For self-employed tax help, contact info@bomcas.ca

View Our Location

View Our Location

181 Meadowview Bay, Sherwood Park, AB T8H 1P7, Canada (Online Clients Only)

181 Meadowview Bay, Sherwood Park, AB T8H 1P7, Canada (Online Clients Only)